一、合法資遣流程5步驟

雇主資遣勞工時,要遵循那些程序才算合法?正常情況下,合法的資遣流程必須經過以下5步驟:

- 符合法定資遣條件

- 向勞工進行資遣預告通知

- 向主管機關進行資遣通報

- 開立非自願離職證明

- 給付資遣費

(一)合法的資遣原因有哪些?

根據勞基法第11條規定,雇主原則上不得任意解雇勞工,除非符合以下任一種情況:

- 歇業或轉讓時。

- 虧損或業務緊縮時。

- 不可抗力暫停工作在一個月以上時。

- 業務性質變更,有減少勞工之必要,又無適當工作可供安置時。

- 勞工對於所擔任之工作確不能勝任時。

律師小提醒:解雇最後手段性原則

以「不能勝任」為由資遣勞工,需符合解雇最後手段性原則。意思是雇主認為勞工不能勝任工作時,需要先提供適當的教育訓練,或輔導轉換工作崗位,如雇主用盡各種手段皆無法改善,或勞工主觀上能為卻不願意履行勞務給付義務,此時才能夠合法使用「解雇」這項最後手段。

(二)資遣預告期多久

雇主資遣勞工時,需要根據勞工的年資給予一定的預告期間,勞工的年資越久,資遣預告期也就越長。

- 年資未滿3個月:無規定預告期。

- 年資3個月以上、未滿1年者:10日。

- 年資1年以上、未滿3年者:20日。

- 年資3年以上者:30日。

若資遣未符合預告期規定,則雇主必須支付勞工所損失的預告期工資。

(三)如何辦理資遣通報?

根據就業服務法第33條規定,雇主資遣員工時,應於員工離職之10日前,將被資遣員工之姓名、性別、年齡、住址、電話、擔任工作、資遣事由及需否就業輔導等事項,列冊通報當地主管機關及公立就業服務機構。但其資遣係因天災、事變或其他不可抗力之情事所致者,應自被資遣員工離職之日起3日內為之。

若雇主未在期限內辦理資遣通報,可能被裁罰新臺幣3萬元以上15萬元以下的罰鍰。

1.資遣工作未滿3個月的勞工,是否仍需於10日前資遣通報?

資遣工作未滿3個月的勞工雖不需給予預告期,但仍需於10日內向主管機關進行資遣通報。因此雇主若臨時決定資遣勞工,至少也需將離職日順延至10日後,但可不必預先向勞工通知。

2.資遣通報會讓勞工提前知道自己被資遣嗎?

主管機關接獲資遣通報,會於「離職生效日」後主動聯繫勞工詢問有無需要安排就業輔導等協助,並不會讓勞工提前知道自己即將被資遣。

(四)勞工權利與雇主義務

除了遵循合法的資遣程序外,雇主還需要履行以下義務,同時也是被資遣勞工可以主張的權力。

1.給予謀職假

在資遣預告期間,雇主應給予每週最多2個工作日的謀職假,工資照給,使被資遣勞工有機會於工作期間請假外出謀職。

2.開立非自願離職證明

非自願離職證明是勞工朋友申請勞保失業給付、就保職業訓練生活津貼或提早就業獎勵津貼時必須檢附的重要資料。

通常雇主都會主動開立非自願離職證明給勞工,如果未開立則勞工有權利向雇主索取。雇主拒絕開立非自願離職證明,可能違反勞基法第19條規定,勞工可向主管機關申訴檢舉。

3.開立服務證明

服務證明中會記錄勞工受雇期間的職位、職務內容、任職期間與薪資等事項,可以做為謀職履歷的佐證。

根據勞基法第19條規定,如遇勞工索取服務證明,雇主有義務提供,否則勞工可向主管機關申訴檢舉。

(五)例外情況:開除

例外情況是,如果勞工有下列任一行為,則雇主可以「不經預告」且「不給付資遣費」,直接開除勞工:

- 於訂立勞動契約時為虛偽意思表示,使雇主誤信而有受損害之虞者。

- 對於雇主、雇主家屬、雇主代理人或其他共同工作之勞工,實施暴行或有重大侮辱之行為者。

- 受有期徒刑以上刑之宣告確定,而未諭知緩刑或未准易科罰金者。

- 違反勞動契約或工作規則,情節重大者。

- 故意損耗機器、工具、原料、產品,或其他雇主所有物品,或故意洩漏雇主技術上、營業上之秘密,致雇主受有損害者。

- 無正當理由繼續曠工三日,或一個月內曠工達六日者。

以上除了第5點以外,其他情況下,雇主都必須在「知悉其情形起30日內」完成開除,若超過此期間,仍然不屬於合法的解僱程序。此外,開除與資遣不同,因此不需要提前進行資遣通報,雇主可以請勞工當下離職,但仍需依法開立非自願離職證明與服務證明給勞工。

★延伸閱讀:盜賣公司資產, 員工有什麼法律責任?公司、消費者這樣處理!

★延伸閱讀:圖解大量解僱勞工的合法通報流程、期限、違規罰款

二、如何計算資遣費?律師實算示範

許多勞工朋友遇到勞資糾紛時,不太清楚自己的損失金額、資遣費該如何計算。了解自己的工資結構,清楚算出工資和資遣費是勞工自保的第一步!

(一)計算資遣費前,先搞懂工資!

計算資遣費要以「工資」為基礎。在勞動法規上,不論給付名目為何,也不論給付頻率為月薪、日薪、時薪或案件計酬,只要是「因工作而獲得的報酬」都可以被認定為工資。相反的,若非勞工用工作換取的報酬,而是雇主為了感謝、體恤勞工所發放的「恩惠性給予」,就不會被認定是工資的一部分。

★延伸閱讀:4步驟申訴欠薪、申請工資墊償,勞工、雇主教戰守策

1.下列給付屬於工資:

- 薪資

- 輪班津貼

- 值勤津貼

- 績效獎金

- 全勤獎金

- 久任獎金

- 膳宿、實物(限有明文約定以實物交付工資者)

2.下列給付「不」屬於工資:

- 年終獎金

- 三節獎金

- 獎勵分紅

- 交通補助

- 誤餐費

- 職災補償費

- 差旅費

(二)新舊制資遣費怎麼計算?

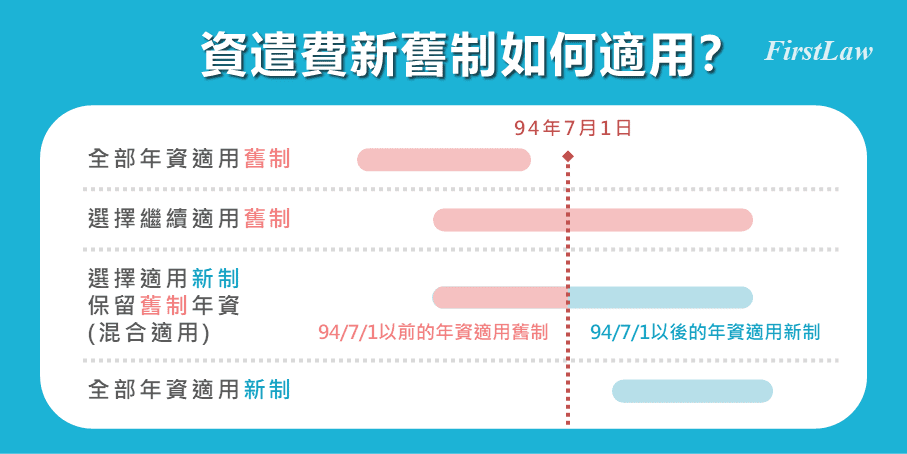

資遣費的計算主要需考量勞工的「年資」與「月平均工資」,以94年7月1日為界,劃分舊制與新制。資遣費新舊制在年資認定與最後實算金額都有差異,以下會分別介紹新制、舊制的計算方法,並附有實際計算過程的示範。

1.新舊制資遣費如何適用?

原則上94年7月1日以前離職的勞工,全部年資都適用舊制,而94年7月1日以後才受雇的勞工,全部年資都適用新制。如果您的年資剛好橫跨94年7月1日,在計算資遣費時可選擇「繼續適用舊制」或「適用新制但保留舊制的年資」。

2.新制資遣費計算:適用94年7月1日以後受僱者

新制資遣費適用對象:

- 94年7月1日才受僱於該事業單位者

- 受僱於94年7月1日以後才適用勞基法的單位者

- 年資橫跨新舊制,但 94年7月1日以後之年資改選新制者

新制資遣費計算公式:

年資(單位:年)x1/2x月平均工資=資遣費

- 「月平均工資」定義:「平均工資」x 月平均日數

- 「平均工資」定義:資遣前6個月的總工資所得 ÷ 總日數

新制年資計算方式:

- 年資未滿一年之部分:按月數比例計算,1月=1/12年

- 年資未滿一月之部分:1日=1/30月

- 最高以發給6個月平均工資為限

3.舊制資遣費計算:適用94年7月1日前受僱者

舊制資遣費適用對象

- 從受僱到資遣都發生於94年7月1日以前者,全部年資適用舊制

- 年資橫跨新舊制,但選擇全部年資繼續適用舊制者

- 年資橫跨新舊制,但選擇94年7月1日以前之年資適用舊制

舊制資遣費計算公式:

年資(單位:年)x月平均工資=資遣費

- 「月平均工資」定義:「平均工資」x 月平均日數

- 「平均工資」定義:資遣前6個月的總工資所得 ÷ 總日數

舊制年資計算方式:

- 年資未滿一年之部分:以平均工資按月數比例計算。

- 年資未滿一月之部分:未滿一月部分以一月計。

4.資遣費計算示範

假設一全職勞工於某年元旦被資遣,年資5年2個月又6天,資遣前6個月每月薪資均為60,000元,另有業績獎金8,000元,和年終獎金1個月月薪。其平均工資、月平均工資、年資與新舊制資遣費計算方式分別如下:

【平均工資、月平均工資】

資遣前6個月總工資=60000(薪資)+8000(業績獎金屬於工資)=368,000元

*年終獎金屬於恩惠性給予,不計入工資。

資遣前6個月總日數=184日

資遣前6個月的每月平均日數=184 ÷ 6=30.67日

#平均工資=368000 ÷ 184=2000元

#月平均月工資=2000 x 30.67= 61,340元

【新制年資】

5年2個月又6天

6天:每1日計為1/30月,故等於1/60月。

2個月又6天:等於(2+6/30)/12=11/60年。

#新制總年資=5+11/60=311/60年

【新制資遣費】

月平均工資61,340 x 1/2 x 年資311/60年=158,972.8

#新制資遣費=158,972元(角以下無條件進位)

【舊制年資】

5年2個月又6天

6天:未滿1個月者以1個月計,故等於1/12年。

2個月:等於2/12年。

#舊制總年資=5+1/12+2/12=5.25年

【舊制資遣費】

月平均工資61,340*年資5.25年=322,035

#舊制資遣費=322,035元

律師小提醒:計算年資和資遣費金額時,小數點怎麼進位?

不論新舊制,在計算資遣費年資的時候都不需將小數點四捨五入,直接以實際基數採計即可,如果想避免無限循環小數,也可以採用311/60這樣的分數計算會更加便利,等到最終算出資遣費金額時再無條件進位至整數即可唷!

三、違法解雇糾紛如何處理?

訴諸司法保障並非勞工獨有的特權,而是勞雇雙方皆可享有的權利。遇到資遣糾紛時,不論是未遵循法定資遣程序、未給付資遣費或資遣事由有爭議,勞工與雇主都可以透過以下途徑來解決。

- 勞資自行協商

- 向主管機關申訴

- 非訟/訴訟紛爭解決機制

(一)勞資自行協商

若勞工與雇主還有溝通的可能,自行協商或許是最快速簡便的途徑,尤其可以幫助勞工節省時間與經濟成本,早日獲得金錢補償,避免生活陷入困難。不論勞工或雇主,在展開協商前都可以先與律師諮詢,分析事實狀況、潛藏風險與適用的法律規範,才能掌握最佳談判籌碼。

(二)向主管機關申訴

若勞工認為雇主有違反勞動法規的情形,可以準備相關證據資料,向所在縣市的主管機關提出申訴檢舉,讓主管機關對雇主進行勞動檢查,釐清究竟有無違規事實存在,並依法予以處分。雇主面對勞動檢查,也可以提出有利於己的資料來陳述意見,作為主管機關處份的基礎之一,因此不全然對雇主不利。

勞動申訴本身雖不能直接為勞工或雇主爭取到補償措施,但勞動檢查的結果可以作為未來訴訟上有利的證據之一。

(三)勞資爭議調解與訴訟

隨著勞動事件法、勞資爭議處理法的推行,勞資糾紛解決管道的選擇更加多元,也大幅縮短程序時間。此外,還提供勞工地緣上的便利措施以就近應訊,同時減少勞工在程序費用上的負擔,讓勞工有較平等的地位與資方抗衡,但對雇主方面則欠缺這些保障,因此雇主必須自行負擔一切成本支出。

勞雇雙方可根據勞資爭議處理法規定,透過主管機關或工會,提出調解、仲裁或裁決程序,透過非訟途徑來解決紛爭。在調解、仲裁或裁決期間,雇主不得藉故歇業、停工或做出其他不利於勞工之行為,勞工也不得因此罷工或引發其他爭議,使雙方在和平的狀態下進行程序,避免衝突擴大。

如不考慮非訟處理機制,雙方也可以選擇提出訴訟。根據勞動事件法規定,勞資爭議訴訟原則上採強制調解制度,為加速程序,必須在3個月內安排至多3次調解。若調解都不成立,才進入訴訟階段,可視情況提出請求給付資遣費、確認僱傭關係存在/不存在等訴訟,訴訟原則上必須在6個月內審結。

遇到資遣糾紛需要法律協助嗎?不論您是勞工或雇主,都歡迎加入第一法律官方LINE和我們一同討論!